Introduction

The first time most people encounter the WACC equation, it feels intimidating. Greek letters, percentages, tax adjustments—it can look more like a chemistry formula than a financial tool. Yet, once you strip away the jargon, the weighted average cost of capital is simply a way to answer one very human question: What does it really cost this business to use money?

Every company uses capital. Some of it comes from lenders who expect interest. Some comes from shareholders who expect returns. The WACC equation pulls those expectations together into one blended number, reflecting the true cost of funding a business. And that number quietly influences some of the biggest decisions in finance—whether to invest in a project, acquire another company, or even whether the firm is creating or destroying value.

In this guide, we’ll walk through the WACC equation in plain language. You’ll learn what it means, how to calculate it step by step, when to trust it (and when to be cautious), and how professionals actually use it in real-world scenarios. By the end, you won’t just understand the formula—you’ll understand how to think with it.

What the WACC Equation Really Means (In Simple Terms)

At its core, the WACC equation calculates the average cost of financing, weighted by how much each funding source contributes to the company’s capital structure. Most businesses rely on two primary sources: debt and equity.

Think of it like planning a road trip with two friends. One friend pays for gas, the other covers lodging. If gas is cheap and lodging is expensive, your overall trip cost depends on how much you rely on each. WACC works the same way—it blends cheap and expensive capital based on their proportions.

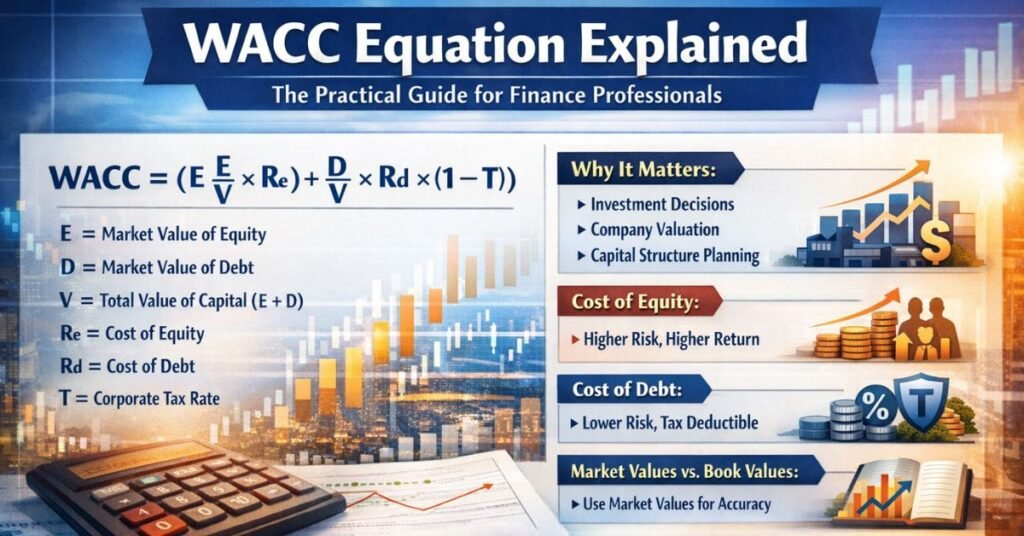

The standard WACC equation looks like this:

WACC = (E / V × Re) + (D / V × Rd × (1 − T))

Where:

- E = Market value of equity

- D = Market value of debt

- V = Total value of capital (E + D)

- Re = Cost of equity

- Rd = Cost of debt

- T = Corporate tax rate

Each component has a clear purpose. Equity is more expensive because shareholders expect higher returns and take more risk. Debt is cheaper, especially after taxes, because interest payments reduce taxable income. The WACC equation balances these realities into one rate that reflects the firm’s overall cost of capital.

Understanding this conceptually is more important than memorizing the formula. If you know why each piece exists, the math becomes far less intimidating—and far more useful.

Why the WACC Equation Matters in Real Business Decisions

The WACC equation isn’t an academic exercise. It shows up everywhere serious financial decisions are made.

Imagine a company considering a new factory. The project promises a 9% return. Is that good? The answer depends entirely on the company’s WACC. If the WACC is 7%, the project creates value. If it’s 11%, the same project quietly destroys shareholder wealth.

Here’s where WACC plays a practical role:

- Capital budgeting: Companies compare expected project returns to WACC to decide what to pursue.

- Valuation models: Discounted cash flow (DCF) analyses rely on WACC as the discount rate.

- Performance measurement: Returns above WACC indicate value creation; returns below it signal inefficiency.

- Strategic planning: Capital structure decisions—how much debt vs. equity to use—directly affect WACC.

In plain terms, the WACC equation acts like a financial hurdle rate. It defines the minimum performance required just to justify using capital. Anything below it isn’t “bad luck”—it’s a structural problem.

This is why seasoned professionals obsess over small changes in WACC. A one-percentage-point shift can change valuations by millions, especially in capital-intensive businesses.

Breaking Down Each Component of the WACC Equation

Understanding the individual parts of the WACC equation is where clarity really clicks. Each input tells a story about risk, expectations, and financial structure.

Cost of Equity (Re)

Equity is expensive because shareholders bear the most risk. They get paid last, after everyone else. As a result, they demand higher returns.

In practice, cost of equity is often estimated using models that consider:

- Risk-free rates (like government bonds)

- Market risk premiums

- Company-specific risk factors

Even though the math can get complex, the idea is simple: What return would investors reasonably expect for owning this stock instead of something safer?

Cost of Debt (Rd)

Debt is usually easier to measure. It’s the interest rate a company pays on its loans or bonds. Unlike equity, debt holders have fixed claims, which makes their expected return lower.

The critical adjustment here is taxes. Because interest is tax-deductible, the effective cost of debt is reduced. That’s why the WACC equation multiplies Rd by (1 − T).

Capital Structure Weights (E/V and D/V)

These weights ensure the equation reflects reality. A company funded 80% by equity should feel equity costs more strongly than one funded 40% by equity.

Importantly, professionals typically use market values, not book values. Market values reflect current investor expectations, which is exactly what WACC is trying to capture.

Step-by-Step: How to Calculate the WACC Equation Correctly

Calculating WACC isn’t hard—but it does require discipline. Here’s a clean, professional process you can follow.

Step 1: Determine Market Value of Equity

Multiply the company’s share price by the number of outstanding shares. This gives you a real-world measure of what investors think the equity is worth today.

Step 2: Estimate Market Value of Debt

For public companies, this may involve bond prices. For private firms, book value is often used as a practical approximation, adjusted if interest rates have shifted significantly.

Step 3: Calculate Cost of Equity

Use a consistent approach and document your assumptions. Small changes here can dramatically affect WACC, so transparency matters.

Step 4: Calculate After-Tax Cost of Debt

Take the interest rate and adjust for taxes. For example, a 6% interest rate with a 25% tax rate becomes 4.5%.

Step 5: Apply the WACC Equation

Plug everything into the formula and double-check your weights sum to 100%.

Best Practices

- Use consistent time frames for all inputs.

- Avoid mixing book and market values unless justified.

- Recalculate WACC when capital structure changes.

This process isn’t just mechanical—it’s analytical. The assumptions you choose say a lot about how you view risk and opportunity.

Benefits and Use Cases of the WACC Equation

The WACC equation shines because it bridges theory and practice. It’s one of the few financial metrics that speaks equally well to analysts, executives, and investors.

Investment Decision-Making

WACC sets a rational benchmark. It prevents companies from chasing growth that looks exciting but fails to compensate capital providers.

Business Valuation

In valuation work, WACC anchors future cash flows to present reality. Without it, projections become guesswork.

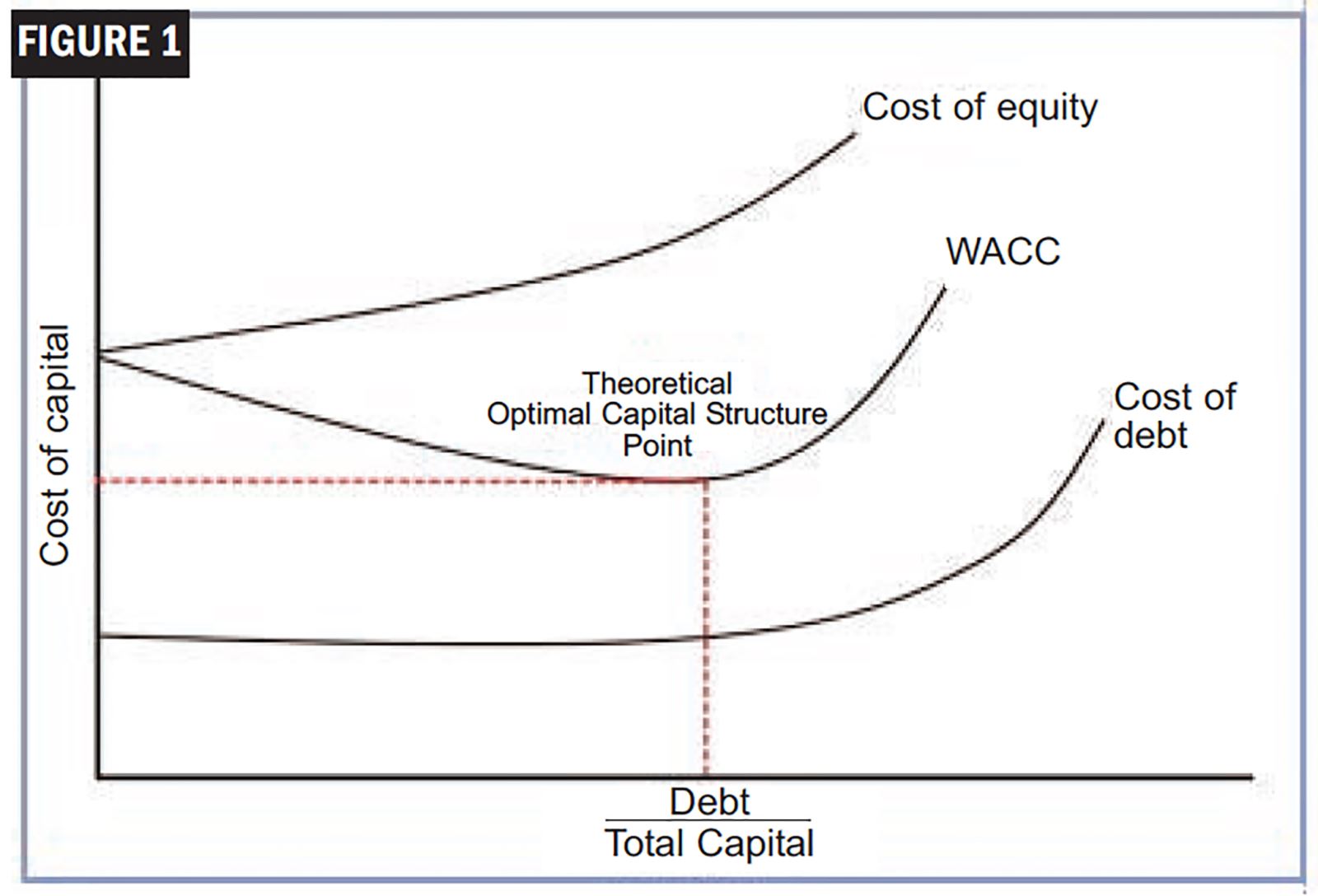

Capital Structure Optimization

Companies often experiment with debt and equity mixes to minimize WACC. A lower WACC increases valuation without changing operations—a powerful lever.

Performance Evaluation

Managers can be evaluated based on returns relative to WACC, aligning incentives with value creation.

In short, the WACC equation isn’t about math—it’s about discipline. It forces businesses to confront the true cost of their ambitions.

Tools, Comparisons, and Practical Recommendations

Professionals rarely calculate WACC in isolation. They use tools to streamline inputs and stress-test assumptions.

Free Tools

- Spreadsheet templates (Excel or Google Sheets)

- Online WACC calculators for quick estimates

Pros: Accessible, flexible

Cons: Easy to misuse without understanding assumptions

Paid Financial Platforms

- Integrated valuation and modeling software

- Market data feeds for accurate inputs

Pros: Accuracy, consistency, scalability

Cons: Cost, learning curve

Expert Recommendation

Start simple. Use spreadsheets to understand the mechanics. As stakes grow, invest in better data and tools. The WACC equation is only as good as the assumptions behind it.

Common Mistakes with the WACC Equation (and How to Fix Them)

Even experienced professionals stumble with WACC. Here are the most common errors.

Using Book Values Instead of Market Values

Book values reflect history, not current expectations. Fix this by prioritizing market data wherever possible.

Overconfidence in Cost of Equity Estimates

Cost of equity is inherently subjective. Use ranges, not single-point estimates, to test sensitivity.

Ignoring Capital Structure Changes

A company’s WACC isn’t static. Major financing decisions require recalculation.

Applying One WACC to All Projects

Different projects carry different risks. Adjust WACC accordingly or use project-specific hurdle rates.

Avoiding these mistakes transforms WACC from a theoretical number into a strategic tool.

Conclusion: Why Mastering the WACC Equation Pays Off

The WACC equation isn’t about passing finance exams. It’s about making smarter, more grounded decisions with real money on the line. When you understand WACC, you stop asking whether something “feels” profitable and start asking whether it truly earns its keep.

For analysts, it sharpens valuation work. For managers, it disciplines strategy. For investors, it reveals whether growth is meaningful or misleading. Mastering WACC doesn’t make decisions easier—but it makes them better.

If you want to build durable value, learn to respect the cost of capital. The WACC equation is where that respect begins.

FAQs

What is the WACC equation used for?

It’s used to calculate a company’s average cost of capital and evaluate investment decisions.

Why is cost of equity higher than cost of debt?

Equity holders take more risk and therefore demand higher returns.

Should WACC use market or book values?

Market values are preferred because they reflect current investor expectations.

Can WACC change over time?

Yes. Changes in interest rates, risk, or capital structure all affect WACC.

Is a lower WACC always better?

Generally yes, but only if it doesn’t increase risk beyond acceptable levels.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.