In the first 100 days of almost any year, markets obsess over inflation prints, central bank signals, and earnings calls. Yet in recent months, one phrase has quietly dominated conversations in boardrooms, policy circles, and technology summits alike: us china technology competition dimon.

That phrase exists because when Jamie Dimon, the longtime CEO of JPMorgan Chase, speaks about global risk, people listen. Dimon isn’t a politician chasing headlines or a think-tank analyst hedging bets. He’s a practitioner—someone who has steered the world’s largest bank through the 2008 financial crisis, a pandemic, and now a rapidly fragmenting global economy.

His message has been consistent and blunt: the US–China technology rivalry isn’t just another geopolitical storyline. It’s the defining economic, security, and innovation battle of our time.

In this article, we’ll unpack what Dimon really means when he talks about this competition, why it matters to businesses and individuals far beyond Silicon Valley or Beijing, and how you can practically understand—and prepare for—the ripple effects. By the end, you’ll have a clear, grounded view of the stakes, the strategies, and the real-world implications of the US-China tech race.

Understanding the US China Technology Competition Through Dimon’s Lens

At its core, the us china technology competition dimon conversation is about power—who builds the tools that shape the future, who controls the infrastructure behind them, and who sets the rules everyone else must follow.

Dimon often frames this rivalry in practical terms rather than ideological ones. Technology today isn’t just about gadgets or software. It’s the backbone of:

- Economic productivity

- National security

- Financial systems

- Supply chains

- Military capability

Think of modern technology like electricity in the early 20th century. Whoever controlled electrification didn’t just light homes—they powered factories, transportation, and entire economies. In Dimon’s view, advanced chips, artificial intelligence, quantum computing, and secure networks play that same role today.

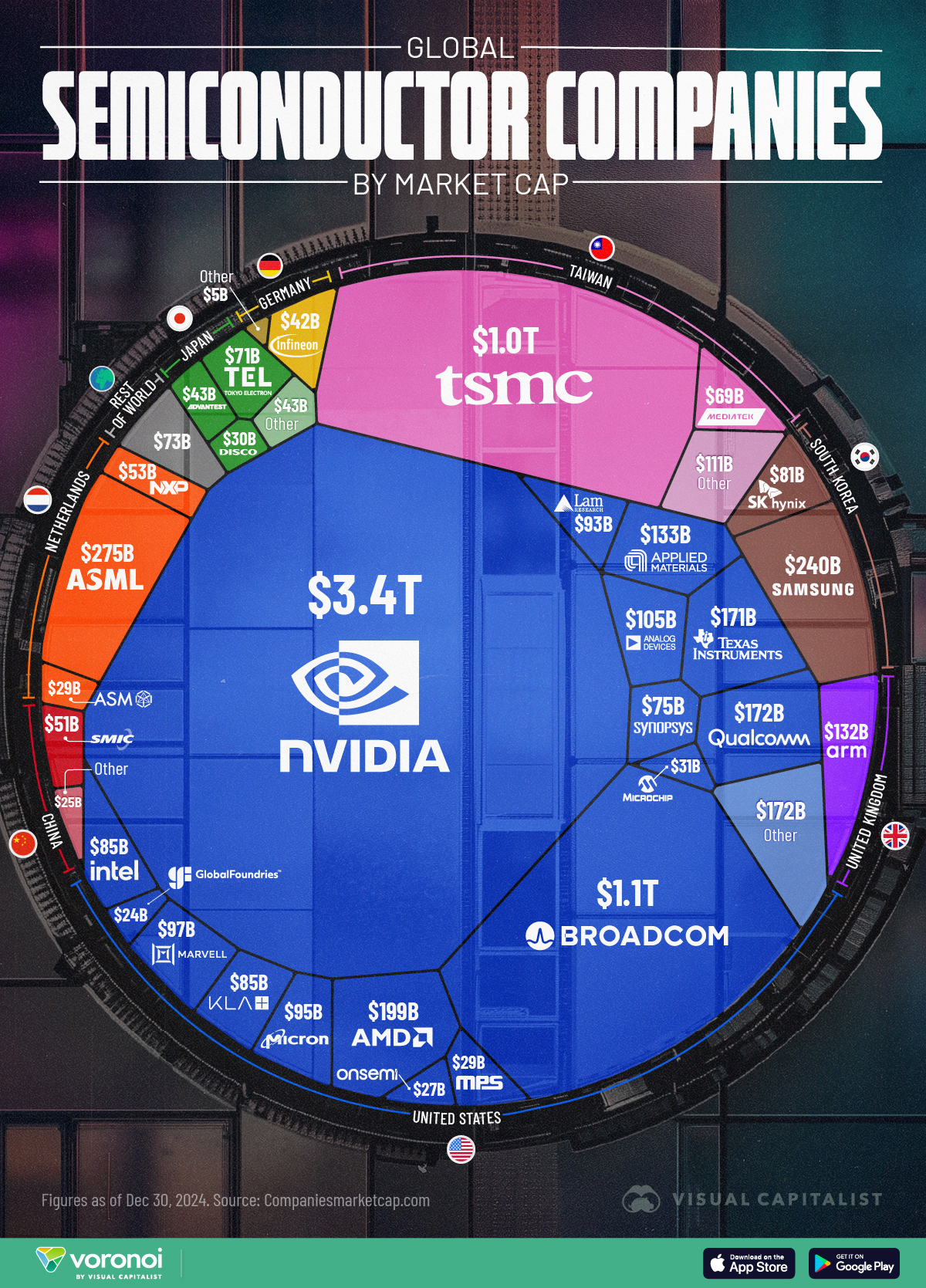

The United States still leads in many foundational areas: chip design, cloud infrastructure, AI research, and financial technology. China, meanwhile, has made staggering progress in scaling manufacturing, deploying AI domestically, and integrating technology deeply into governance and commerce.

Dimon’s concern isn’t that one side will “win” overnight. It’s that fragmentation—export controls, sanctions, parallel standards—could reshape global growth for decades. Instead of one interoperable tech ecosystem, we may be heading toward two partially disconnected worlds. For global finance and commerce, that’s not just inefficient—it’s risky.

Why the US China Technology Competition Matters to Everyone

It’s tempting to think this is a problem only for policymakers or multinational CEOs. Dimon repeatedly pushes back on that assumption.

If you use a smartphone, invest through a retirement account, work in a company with digital tools, or depend on global supply chains (which is basically everyone), this competition already affects you.

Here’s how it shows up in everyday life:

- Semiconductor shortages raise prices for cars and electronics

- AI regulations influence which tools companies can deploy

- Trade restrictions impact jobs and wages

- Cybersecurity risks affect banks, hospitals, and utilities

Dimon often emphasizes that finance sits at the center of all this. Banks fund innovation, insure risk, and connect capital across borders. When tech competition escalates, financial institutions feel it first—through compliance costs, operational complexity, and geopolitical exposure.

This is why his warnings resonate. He’s not speculating from the sidelines. He’s watching capital flows, corporate investment decisions, and risk models shift in real time.

The Technologies at the Heart of the US–China Rivalry

To understand the us china technology competition dimon narrative, you need to know which technologies actually matter. Dimon consistently highlights a handful that act as force multipliers.

Semiconductors: The New Oil

Advanced chips power everything from smartphones to fighter jets. The US dominates design, while much manufacturing is concentrated in Asia. China’s push for self-sufficiency—and America’s export controls—sit at the center of the conflict.

Artificial Intelligence

AI isn’t just about chatbots. It drives logistics optimization, fraud detection, military surveillance, and scientific discovery. Dimon often notes that whoever leads in AI sets productivity curves for entire industries.

Cybersecurity and Financial Infrastructure

Banks, payment systems, and capital markets rely on secure digital rails. Dimon has warned that cyber warfare could become as destabilizing as traditional military conflict.

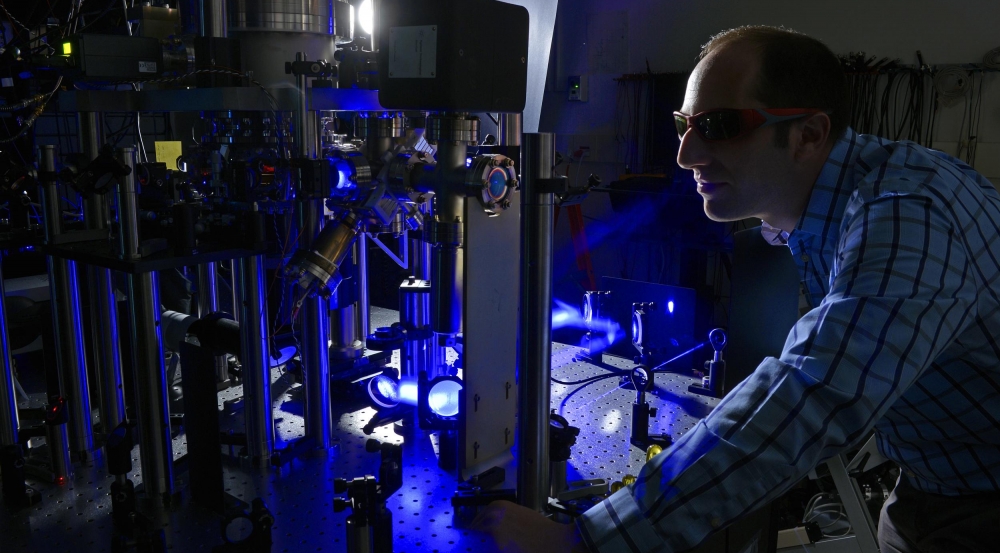

Quantum Computing

Still early-stage, but potentially transformative. Quantum breakthroughs could upend encryption, finance modeling, and national security.

Each of these technologies compounds the others. Leadership in one accelerates progress in the rest.

Benefits and Use Cases: Who Gains from Understanding This Competition?

Understanding the us china technology competition dimon perspective isn’t just academic. It creates real advantages depending on who you are.

For Business Leaders

Executives who grasp this rivalry can:

- Diversify supply chains before disruptions hit

- Make smarter long-term capital investments

- Navigate regulatory risk more confidently

A CEO who assumes “globalization as usual” may get blindsided. One who listens to Dimon’s warnings builds resilience.

For Investors

Technology competition reshapes valuations. Export controls, subsidies, and industrial policy all affect earnings.

Investors who understand the macro picture can:

- Identify structural winners and losers

- Avoid concentration risk in geopolitically exposed sectors

- Balance growth with stability

For Policymakers and Analysts

Dimon’s framing offers a bridge between finance and geopolitics. It helps policymakers think beyond slogans and focus on incentives, capital flows, and execution.

For Professionals and Workers

Skills tied to strategic technologies—AI, cybersecurity, advanced manufacturing—become more valuable. Understanding the rivalry helps individuals future-proof careers.

A Step-by-Step Framework to Analyze the US China Technology Competition

One of the most useful things you can do is develop a structured way to think about this rivalry. Here’s a practical, Dimon-inspired framework.

Step 1: Identify the Strategic Technology

Ask:

- Is this technology foundational or incremental?

- Does it affect national security or economic infrastructure?

Foundational technologies attract government intervention.

Step 2: Map the Supply Chain

Where are:

- Inputs sourced?

- Manufacturing done?

- Software developed?

Dimon often stresses that fragility hides in complexity.

Step 3: Understand Policy Signals

Watch:

- Export controls

- Subsidies

- Regulatory changes

Policy often moves faster than markets expect.

Step 4: Assess Financial Exposure

Consider:

- Capital intensity

- Cross-border revenue

- Currency and compliance risk

Banks model these risks constantly—individuals should too.

Step 5: Plan for Multiple Scenarios

Dimon’s hallmark advice: don’t bet on one outcome. Build flexibility.

Tools, Comparisons, and Strategic Recommendations

You don’t need a Wall Street risk desk to stay informed. Several tools help track the us china technology competition dimon dynamic.

Free Resources

- Policy briefings from global economic forums

- Academic research on technology policy

- Public earnings calls and shareholder letters

Pros: Accessible, broad perspective

Cons: Less timely, less actionable

Paid Intelligence Platforms

- Geopolitical risk analytics

- Supply chain visibility software

- Market intelligence subscriptions

Pros: Timely, data-driven insights

Cons: Cost, information overload

Expert Recommendation

Blend both. Use free sources for context, paid tools for decisions that involve capital or careers.

Common Mistakes People Make—and How to Fix Them

Even smart professionals misread this competition. Here are frequent errors Dimon implicitly warns against.

Mistake 1: Treating It as Pure Politics

Fix: Follow money, incentives, and infrastructure—not just rhetoric.

Mistake 2: Assuming Decoupling Is Total

Fix: Expect partial separation with continued interdependence.

Mistake 3: Ignoring Second-Order Effects

Fix: Ask how regulations ripple through suppliers, customers, and finance.

Mistake 4: Overreacting to Headlines

Fix: Focus on trends, not daily news cycles.

The Financial System’s Role in the US China Tech Competition

Dimon repeatedly emphasizes that finance isn’t neutral plumbing—it actively shapes outcomes.

Banks decide:

- Which technologies get funded

- Which regions attract capital

- How risk is priced

As compliance costs rise and geopolitical risk increases, capital becomes more selective. This subtly but powerfully influences innovation trajectories.

From Dimon’s perspective, this is why coordination between governments and financial institutions matters. Fragmentation without planning raises costs for everyone.

What the Future Might Look Like (Without Making Wild Predictions)

Dimon avoids crystal-ball forecasts, but he does outline plausible futures.

We’re likely to see:

- Parallel tech ecosystems with limited interoperability

- Increased domestic investment in strategic sectors

- Higher costs but greater resilience

This isn’t the end of innovation. It’s a shift in how innovation is organized and financed.

Conclusion: Why Dimon’s Perspective Is a Wake-Up Call

The us china technology competition dimon conversation matters because it cuts through noise. It reminds us that technology, finance, and geopolitics are no longer separate domains.

Dimon’s core message is pragmatic: prepare, diversify, invest wisely, and don’t assume yesterday’s rules still apply.

Whether you’re running a company, managing investments, or planning a career, understanding this rivalry isn’t optional anymore. It’s part of the operating environment.

If there’s one takeaway, it’s this: the future won’t be decided by ideology alone—but by execution, resilience, and smart allocation of capital.

FAQs

What does Jamie Dimon say about US-China technology competition?

He warns it’s a defining global risk affecting finance, security, and long-term growth.

Why is technology central to US-China rivalry?

Because advanced tech underpins economic power, military capability, and innovation leadership.

How does this competition affect everyday people?

Through prices, jobs, investment returns, and access to technology.

Is full decoupling between US and China likely?

No. Partial decoupling with continued interdependence is more realistic.

Which sectors are most impacted?

Semiconductors, AI, cybersecurity, and advanced manufacturing.

Adrian Cole is a technology researcher and AI content specialist with more than seven years of experience studying automation, machine learning models, and digital innovation. He has worked with multiple tech startups as a consultant, helping them adopt smarter tools and build data-driven systems. Adrian writes simple, clear, and practical explanations of complex tech topics so readers can easily understand the future of AI.